Selecting the Right Financial Education Gifts for Kids

When choosing financial education gifts for kids, it’s essential to consider products that are not only engaging but also educational in a practical sense. The goal is to introduce and reinforce concepts of financial education in a manner that resonates with children. This can range from simple saving methods to more complex ideas like investing and the workings of banks and credit cards. The ideal gift should be age-appropriate, interactive, and fun, making the learning process both enjoyable and memorable. By instilling these concepts early, children can develop a strong foundation in financial literacy, preparing them for future challenges in the stock market and beyond.

Jump to Financial Education Gifts for Kids List

Building Financial Literacy Foundations

The first step in financial education for kids often involves understanding basic saving principles. Savings-themed gifts, such as attractively designed piggy banks or easy-to-use savings apps, make learning about money management approachable and exciting. Board games that involve money transactions or budget management can also play a crucial role in teaching young minds the value of money and the importance of saving. These interactive tools are excellent for demonstrating the fundamental concepts of financial education in a context that children can easily grasp and enjoy.

Introducing Advanced Financial Concepts

As kids grow older, their understanding of money should evolve to include more advanced financial topics like investing, the stock market, credit cards, and how banks operate. Educational gifts that simulate real-life financial scenarios, such as stock market board games or investment challenge apps, can be instrumental in this stage. Books and workshops designed for young audiences that cover topics like how credit cards work or the basics of the stock market can also be valuable. These resources are crucial in building a more in-depth understanding of the financial world, setting the stage for responsible money management in their adult lives.

As an Amazon Associate I earn from qualifying purchases. Please see our Advertiser Disclosure

Financial Education Gifts for Kids

1. BankIt Money Game for Kids

This engaging board game is a fantastic way for kids aged 8 and up to learn about money management in a fun, interactive way. By simulating real-life financial scenarios, it teaches them the value of saving, spending wisely, and even the basics of earning bank interest. The game encourages strategic thinking and decision-making, skills that are invaluable in the real world. It’s a great tool for family game nights, combining fun with educational value in understanding personal finances.

2. Rich Dad CASHFLOW for Kids

This board game is an excellent way for children as young as 6 years old to grasp the basics of financial literacy. By differentiating between assets and liabilities and practicing real-world investing scenarios with play money, it makes complex financial concepts accessible and engaging for kids. This game not only teaches them how money works but also lays the groundwork for sound financial habits in the future. It’s a fun, interactive way to introduce children to the world of finance and investing.

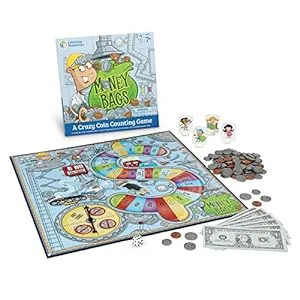

3. Money Bags Coin Value Game

This coin value game is perfect for kids aged 7 and up, blending fun with education in a dynamic way. It’s a hands-on approach to teaching kids how to collect, count, and exchange money, thereby developing their math skills and money recognition. The inclusion of play money in the game makes the learning process more tangible and enjoyable. It’s an ideal gift for parents looking to give their kids a head start in financial literacy through engaging and interactive play.

4. Pretend-to-Spend Toy Wallet

This pretend-to-spend toy wallet is an excellent educational tool for kids aged 3 and up. It includes play money and cards, allowing children to engage in pretend shopping and errands, thus introducing them to the basics of money handling and transactions. The inclusion of different denominations and coins, along with various cards, helps children understand the different aspects of money and credit. It’s a creative way to teach young kids about financial responsibility in a playful and engaging manner.

5. Business and Financial Education Game

This innovative game is a unique blend of financial education and personal development for children. It teaches kids not just about using money but also incorporates aspects of physical, mental, and emotional development. The game’s approach to decision-making in financial contexts, like spending and investing, makes it a standout choice. It’s especially appealing for those who find traditional math or complex games challenging, offering a fun and accessible way to learn about money.

6. ATM Money Bank for Kids

This electronic piggy bank is a modern twist on the classic money-saving concept, perfect for children aged 3-12. It combines the excitement of a mini ATM with the practicality of a money-saving box, teaching kids about saving in a high-tech way. The password protection feature adds an element of security, making the saving process more realistic and engaging. It’s a fun and educational way for kids to learn the importance of saving money, combining play with practical financial lessons.

7. Financial Literacy Fun Flashcards

These financial literacy flashcards offer a diverse and engaging way for kids and teens to learn essential money concepts. The three skill levels cater to a range of ages and knowledge bases, making it a versatile educational tool. The combination of attractive imagery and simple definitions ensures that learning about finance is both fun and accessible. These flashcards are designed to last, offering a durable and lasting educational resource for financial literacy.

8. Stock Exchange Game

The Stock Exchange Game is an excellent choice for families and individuals aged 10 and up, interested in learning about finance in a fun and engaging way. It requires no prior stock market knowledge, making it accessible to everyone. The game offers three levels of play, catering to different skill levels and interests, from casual family fun to more strategic team play. It’s a fantastic way to introduce the principles of the stock market and financial management without the need for heavy math or economic expertise.

9. Magnetic Money for Kids

This magnetic money set is an innovative educational tool that helps children master money identification and develop math skills. The set includes various denominations of coins and bills, making it a hands-on way for kids to learn about the value and usage of money. The magnetic feature allows for interactive learning, as children can adhere the pieces to magnetic surfaces for a variety of engaging activities. It’s an excellent gift for fostering early financial awareness and math skills in a fun and interactive way.

10. Checkbook for Kids

This checkbook set offers a unique and interactive way for kids to learn about financial transactions and banking. It includes realistic-looking checks, deposit slips, and check registers, just like those used in real-life banking. This hands-on approach makes learning about financial literacy fun and practical, teaching kids how to manage a checkbook and understand bank transactions. It’s a great tool for parents and teachers to introduce children to the basics of financial responsibility in an enjoyable and relatable manner.

11. Game of Life

This family board game is a fantastic way for kids to learn about life’s financial decisions in an entertaining setting. Players get to make crucial choices about education, career, and investments, mimicking real-life financial planning and consequences. The game’s investment component introduces kids to the concept of growing money, making it an excellent tool for teaching basic financial literacy. It’s a fun and interactive way for the whole family to learn about the financial implications of life choices.

12. Kids Wallet

These wallets are more than just a novelty item for kids; they’re a practical tool for teaching money management. Designed with various compartments for cash, coins, and cards, they help children learn how to organize and handle money responsibly. The inclusion of a zippered coin pocket and multiple card holders makes the experience realistic, preparing them for future financial independence. They’re an ideal gift for helping kids understand the value of money and the basics of personal finance from a young age.

13. Managing My Allowance Money Game

This allowance management game is a clever way to teach kids about budgeting and saving for future goals, like college. By requiring players to make smart financial decisions and take advantage of sales, it mimics real-life money management scenarios. The game is designed for multiple skill levels, making it adaptable and challenging for children of different ages. It’s a fun, practical, and social learning tool that moves beyond textbooks, offering a hands-on approach to understanding money.

14. Raising Entrepreneurial and Money Smart Kids Flashcards

These flashcards are a straightforward and effective way to introduce kids to financial literacy. Covering 52 essential financial terms, they make complex concepts easy to understand for young minds. The visually engaging cards, complete with definitions and open-ended prompts, encourage children to discuss and internalize each financial concept. This approach makes learning about money management both engaging and accessible, paving the way for a financially literate future generation.

15. Make Your Kid A Money Genius

This book is a comprehensive guide for parents who want to raise money-savvy kids. It offers practical advice and strategies for teaching children of all ages, from toddlers to young adults, about money management. The book covers a wide range of topics, including allowances, spending, saving, and investing, making it an invaluable resource for parents. It’s an essential tool for anyone looking to impart financial wisdom to their children, regardless of their own financial expertise.

16. The Entrepreneur Game

This board game is a unique educational tool that teaches children and adults about entrepreneurship and financial management. Being STEM accredited, it offers a comprehensive learning experience, covering aspects like critical thinking, decision-making, and financial literacy. The game promotes creativity and life skills, preparing players for entrepreneurial success. It’s an engaging way to transform homes and classrooms into exciting learning environments, making game night both fun and educational.

17. Financial Literacy Memory Matching Game

This financial literacy-themed memory matching game is a fun and educational tool for children and families. It combines the challenge of a memory game with the learning of financial concepts, making it an excellent way for kids to improve critical thinking and problem-solving skills. The game is great for solo play or family bonding, providing an enjoyable way to introduce children to financial literacy. Its design, with increased size and thickness, ensures durability and easy handling, making it a perfect educational gift.

18. X-Large Piggy Bank

This digital coin counting piggy bank is an exceptional tool for teaching kids and adults alike the value of saving. Its large capacity can hold over 2000 coins, making it perfect for long-term saving goals. The unique feature of this piggy bank is its digital counter that automatically calculates the total amount saved, providing instant feedback and a sense of achievement. Additionally, its durable design and clear display make it a practical and motivating way to track savings progress, making it a great gift for anyone learning the importance of saving.

19. Cash Register for Kids

This pretend and play calculator cash register is an excellent educational toy for introducing young children to basic math and money handling skills. It comes equipped with a working solar-powered calculator, play money, and a pretend credit card, offering a realistic experience in a playful setting. The cash register’s sound effects add to the realism, making it an engaging way for kids to learn about transactions, money management, and basic arithmetic. This toy is not only fun but also a practical tool for developing early math skills, making it a fantastic gift for young learners.

20. Financial Literacy for Kids

This collection of 20 original stories provides an innovative approach to teaching financial literacy to kids. Each story is designed to illustrate various aspects of money management, from saving and spending to the broader concepts of financial responsibility. The stories are engaging and relatable, making complex financial concepts more understandable for children. This book is a unique gift that combines the joys of storytelling with essential lessons in personal finance, perfect for helping kids grasp the importance of controlling and growing their money.

21. Monopoly

The Monopoly game is a classic family board game that teaches valuable lessons in financial management and real estate. Players engage in buying, selling, and trading properties, learning about investment, negotiation, and strategic planning. The game’s competitive nature encourages players to think critically about money management and the consequences of financial decisions. Its appeal across ages and its ability to make financial concepts fun and accessible make Monopoly a great gift for families looking to enjoy quality time while imparting financial wisdom.

Empowering Kids with Financial Knowledge

In conclusion, providing financial education gifts for kids is a meaningful way to equip the younger generation with essential money management skills. From teaching basic saving techniques to introducing them to the complexities of investing and the stock market, these gifts offer a spectrum of learning opportunities. By engaging children in financial education through practical and enjoyable methods, we can help them build a solid foundation for their future. It’s about empowering them with the knowledge and tools they will need to make informed decisions about banks, credit cards, and investments, ensuring a financially savvy future generation.

Please Share

If you have enjoyed this page or found the information provided valuable, we kindly ask you to consider sharing it on your social media platforms. Sharing is a great way to help others discover and benefit from the resources and insights available here. Your support in spreading the word is highly appreciated and can make a positive impact on the lives of others. Thank you for your support!